More About Paul B Insurance

Wiki Article

Paul B Insurance Fundamentals Explained

Table of ContentsGetting My Paul B Insurance To WorkThe Buzz on Paul B InsuranceGetting The Paul B Insurance To WorkPaul B Insurance Fundamentals ExplainedGetting My Paul B Insurance To WorkFacts About Paul B Insurance Uncovered

With home insurance coverage, for instance, you might have a substitute price or actual money worth plan. You need to always ask how insurance claims are paid as well as what the insurance claims process will be.

The idea is that the cash paid in cases over time will be much less than the complete costs collected. You may feel like you're tossing cash out the window if you never sue, however having item of mind that you're covered in case you do suffer a considerable loss, can be worth its weight in gold.

Fascination About Paul B Insurance

Visualize you pay $500 a year to insure your $200,000 residence. This indicates you have actually paid $5,000 for residence insurance coverage.Due to the fact that insurance policy is based upon spreading out the threat amongst lots of people, it is the pooled money of all individuals paying for it that permits the firm to develop assets as well as cover cases when they take place. Insurance is a business. It would be nice for the business to simply leave prices at the same degree all the time, the reality is that they have to make enough money to cover all the prospective cases their insurance policy holders may make.

Underwriting adjustments as well as price rises or declines are based on results the insurance policy company had in past years. They offer insurance policy from just one business.

The Paul B Insurance Statements

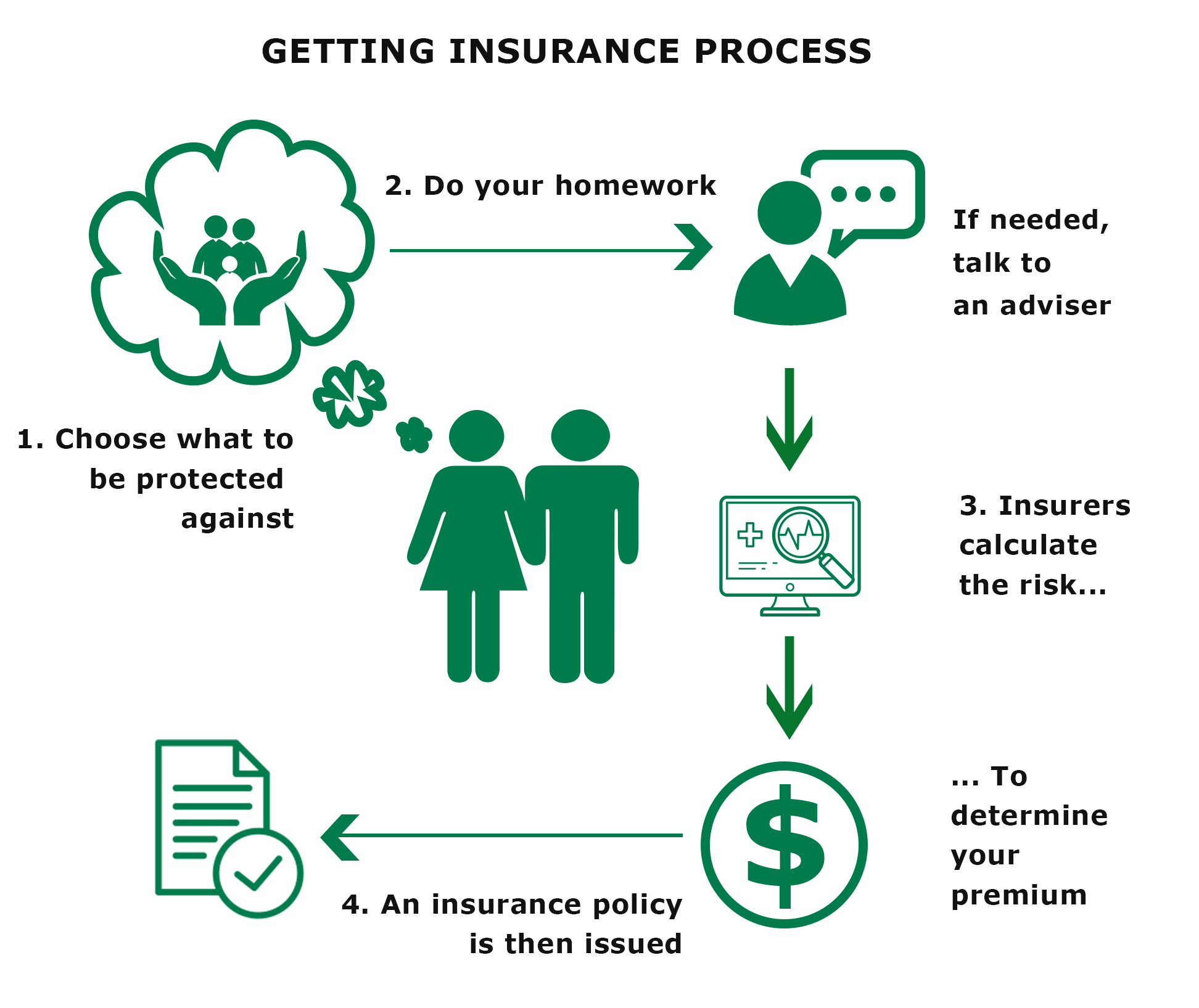

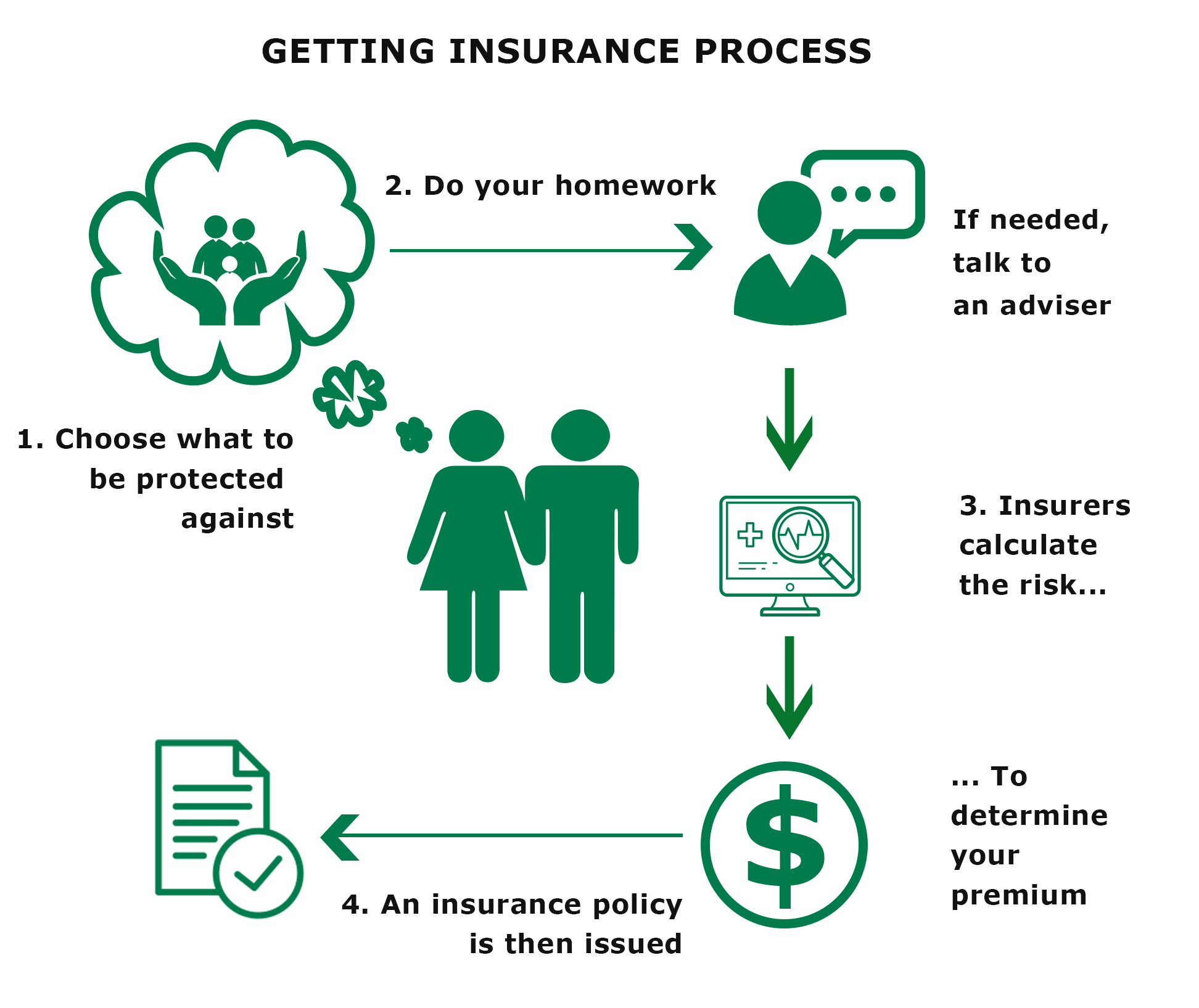

The frontline individuals you handle when you purchase your insurance policy are the representatives and also brokers who stand for the insurer. They will certainly describe the kind of products they have. The captive agent is a rep of just one insurance provider. They a knowledgeable about that company's products or offerings, however can not speak towards various other business' policies, prices, or product offerings.Exactly how much danger or loss of cash can you assume on your very own? Do you have the cash to cover your prices or financial obligations if you have a crash? Do you have special demands in your life that require added protection?

The look at this website insurance you require differs based on where you are at in your life, what kind of properties you have, and what your long-term goals and also duties are. That's why it is important to make the effort to review what you want out of your plan with your representative.

Paul B Insurance Fundamentals Explained

If you obtain a loan to purchase a vehicle, and after that something occurs to the car, space insurance policy will certainly repay any kind of section of your lending that common vehicle insurance policy does not cover. Some lending institutions need their consumers to bring space insurance policy.The primary purpose of life insurance coverage is to provide money for your beneficiaries when you pass away. Depending on the kind of plan you have, life insurance coverage can cover: Natural deaths.

Life insurance coverage covers the life of the guaranteed individual. The policyholder, who can be a various person or entity from the guaranteed, pays premiums to an insurer. In return, the insurer pays an amount of money to the recipients listed on the plan. Term life insurance coverage covers you for a time period picked at purchase, such as 10, 20 or three decades.

Some Ideas on Paul B Insurance You Need To Know

Term life is popular due to the fact that it provides huge payments at a reduced cost than long-term life. There are some variants of regular term life insurance policies.Irreversible life insurance policy plans develop cash value as they age. The money worth of whole life insurance coverage policies expands at navigate to this website a set price, while the money value within global plans can vary.

$500,000 of whole life protection for a healthy and balanced 30-year-old female expenses around $4,015 annually, on average. That very same level of protection with a 20-year term life plan would certainly set you back an average of about $188 annually, according to Quotacy, a brokerage firm.

The 8-Second Trick For Paul B Insurance

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

Report this wiki page